Introduction

Motorcycle insurance can be a significant expense, but there are ways to reduce your premiums without sacrificing coverage. This guide will provide you with practical strategies to save money on your motorcycle insurance in 2025. By understanding the factors that influence your rates and making informed choices, you can keep more money in your pocket and still enjoy the open road.

Shop Around and Compare Quotes

One of the most effective ways to save money is to compare quotes from multiple insurers. Don’t just settle for the first quote you receive. Use online comparison tools or contact insurers directly to get a range of prices. Remember that prices can vary significantly between companies, so it pays to do your research. You can even use a service like Compare.com to help you.

Consider Your Coverage Options

Carefully evaluate your insurance needs. While comprehensive coverage offers peace of mind, it often comes with a higher price tag. Think about your budget and the level of risk you are comfortable with. You might find that a slightly less comprehensive plan still meets your needs and saves you money. Learn more about coverage options.

Improve Your Credit Score

Believe it or not, your credit score can impact your motorcycle insurance premiums. Insurers often use your credit history as a factor in assessing risk. By improving your credit score, you can potentially qualify for lower rates. Consider using resources like Credit Karma to track your credit.

Take a Motorcycle Safety Course

Many insurance companies offer discounts to riders who complete a certified motorcycle safety course. These courses demonstrate your commitment to safe riding practices, which can lower your risk profile in the eyes of insurers. Find a course near you.

Bundle Your Insurance Policies

If you also have car insurance, homeowners insurance, or other types of insurance, bundling your policies with a single provider can often result in significant savings. Many insurers offer discounts for bundling, so it’s definitely worth exploring this option. Contact your current provider to see what deals are available.

Maintain a Clean Driving Record

A clean driving record is your best friend when it comes to saving on insurance. Avoid accidents and traffic violations, as these can significantly increase your premiums. This is perhaps the most important thing to remember – careful driving is not only safer but also cheaper in the long run. Learn more about defensive driving.

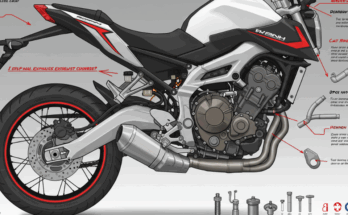

Choose the Right Motorcycle

The type of motorcycle you ride can influence your insurance rates. Higher-performance bikes are typically more expensive to insure due to their higher risk profile. Consider the cost of insurance when making your purchasing decision. Research different models and their associated insurance costs before buying to find a more affordable choice.

Conclusion

Saving money on motorcycle insurance requires a proactive approach. By comparing quotes, understanding your coverage needs, and adopting safe riding habits, you can significantly reduce your premiums. Remember that proactive financial planning, like budgeting apps, can also help you stay on top of your insurance costs.

Frequently Asked Questions

What factors affect motorcycle insurance rates? Several factors determine your rates, including your age, riding experience, credit score, location, and the type of motorcycle you ride.

Can I lower my insurance if I only drive occasionally? Some insurers offer discounts for low mileage or limited usage. It’s worth inquiring about this option with your provider.

How often should I review my motorcycle insurance? It’s a good idea to review your policy annually to ensure you are still getting the best rates and coverage.

What if I have a lapse in coverage? A lapse in coverage can negatively impact your ability to obtain affordable insurance in the future.

What are some discounts I can look out for? Many insurers offer discounts for things like safety courses, multiple-policy bundling, and anti-theft devices.