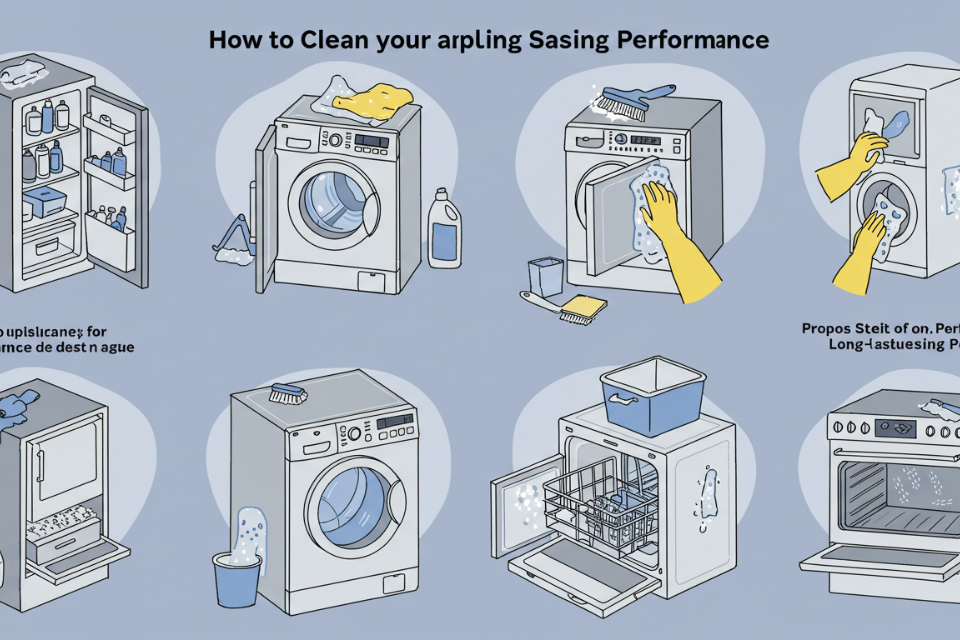

Keeping your appliances clean isn’t just about aesthetics; it’s crucial for their longevity and optimal performance. Regular cleaning prevents buildup that can hinder functionality, reduce efficiency, and even lead to costly repairs. This guide will walk you through cleaning various appliances for a sparkling clean kitchen and extended appliance lifespan.

Cleaning Your Refrigerator

Refrigerators are breeding grounds for bacteria if not cleaned regularly. Start by removing all items and shelves. Wipe down all surfaces with a solution of warm water and baking soda (find a great recipe here). Pay special attention to the door seals and any spills. Don’t forget to clean the condenser coils located at the back or bottom for optimal cooling (learn more about coil cleaning).

Dishwasher Deep Clean

Even dishwashers need a good cleaning! Run an empty cycle with a dishwasher cleaner or a cup of white vinegar to remove food residue and hard water stains. Then, wipe down the interior with a damp cloth, paying attention to the spray arms and filter. A thorough cleaning will improve the efficiency and hygiene of your dishwasher. For stubborn stains, try using a paste of baking soda and water (see our guide for more tough stain removal tips).

Microwave Magic

Microwave cleaning is easy! Place a bowl of water and lemon slices inside and microwave for a few minutes. The steam will loosen splatters and make them easy to wipe away. Remember to clean the turntable and any other removable parts separately. A simple wipe-down with a damp cloth and mild detergent will keep your microwave sparkling.

Oven Cleaning Tips

Oven cleaning can be a daunting task, but it’s essential for maintaining its performance. For light cleaning, use a non-abrasive cleaner and a damp cloth. For stubborn baked-on food, try using a paste of baking soda and water, leaving it overnight before scrubbing. Always refer to your oven’s manual before using any harsh chemicals. Consider using an oven liner to make future cleanups easier. (check out our recommended oven liners)

Washing Machine Maintenance

Clean your washing machine regularly to prevent mold and mildew buildup. Run an empty cycle with hot water and a cup of white vinegar or a washing machine cleaner. This will help remove detergent residue and freshen the machine. Don’t forget to check and clean the lint trap, if applicable. Regular maintenance will significantly extend your washing machine’s life (learn more about extending the life of your washing machine).

Mastering Coffee Maker Cleaning

Coffee makers can accumulate coffee oils and residue over time. To clean yours, fill the reservoir with equal parts water and white vinegar, run a cycle, and then follow up with a cycle of plain water. Regular descaling is vital for maintaining the taste and quality of your coffee and the longevity of your machine. This guide gives more detailed instructions.

Cleaning Your Garbage Disposal

Your garbage disposal needs attention too! Grind ice cubes to sharpen the blades and remove debris. Pour baking soda down the drain followed by white vinegar to deodorize and clean. Avoid putting non-food items into your garbage disposal to keep it functioning efficiently. Always ensure the disposal is running when putting items inside.

Conclusion

By following these simple cleaning tips, you can ensure your appliances run efficiently and last for years to come. Regular maintenance is key to preventing costly repairs and maintaining a clean and hygienic kitchen. Remember, always consult your appliance’s manual for specific cleaning instructions.

Frequently Asked Questions

How often should I clean my appliances? The frequency depends on usage, but generally, a monthly cleaning is recommended for most appliances, with deeper cleanings every 3-6 months.

What cleaning products should I avoid? Avoid abrasive cleaners and harsh chemicals that can scratch surfaces or damage your appliances. Opt for natural cleaners like baking soda and white vinegar whenever possible.

Can I use a steam cleaner for appliance cleaning? Steam cleaners can be effective for some appliances, but always check your appliance’s manual first to ensure it’s safe.

What about my stovetop? Stovetop cleaning depends on the type of stove. For gas stoves, wipe down the grates and burners regularly. For electric, focus on cleaning the cooktop and any spilled food.

How can I prevent future buildup? Always wipe up spills immediately, and try to clean your appliances after each use to prevent grime from accumulating.